Sponsorship Essentials Part 5: Q&A w/ Jason Smith, VP of Corporate Sponsorships & Events at Mountain America Credit Union

Jason Smith is the VP of Corporate Sponsorships & Events at Mountain America Credit Union, a Utah-based credit union that is making big waves in the sponsorship industry. In this week’s edition of “Sponsorship Essentials” he speaks towards his experiences on both the property and corporate sides, the assets that a company should fight for to have a successful sponsorship, and the skills that have gotten him to where he is today.

By: Claire Lingley

Jason Smith is the VP of Corporate Sponsorships & Events at Mountain America Credit Union, a Utah-based credit union that is making big waves in the sponsorship industry. In this week’s edition of “Sponsorship Essentials” he speaks towards his experiences on both the property and corporate sides, the assets that a company should fight for to have a successful sponsorship, and the skills that have gotten him to where he is today.

Q: You made the transition from the property side, being with BYU and IMG and the like, to the corporate side with Mountain America Credit Union. Did you find it was an easy transition?

A: The transition has been interesting, and it’s been a matter of trying to understand the products and services. That was especially true right when I came on board, but now I’ve been doing this for a while so I can speak to it very well.

Overall, it’s been really fun to see both sides of the fence: the property vs. the corporate side. Both sides are focused on helping the company achieve certain marketing goals, but the overall business models are different. On the property side you’re focusing on new companies to bring onto the property through sales efforts, etc. On the corporate side, working for a credit union for example, you have to understand different products and services, like checking and savings accounts, loans, and you have to understand how you can be successful with your sponsorship assets with the company as it relates to the sponsorship. On the corporate side, you’re really focused on how you build the business through the sponsorship, rather than on the property side, you’re thinking, how can we add more revenue to the property through sponsorships?

My mindset has changed a little bit with the transition, but ultimately the goal of both sides should be to make sure the sponsorship is successful for the company.

Q: Can you give me one thing you’ve learned sitting on the corporate side, and one thing you’ve learned on the property side?

“That universe that we live in is small, and everyone talks. It’s important to do what you say you’re going to do. ”

A: On the corporate side, you’ve got an overall marketing strategy, however what may be the right marketing mix or asset mix in one area or region or state, may not be the same mix in another. You have to be flexible in your sponsorships. That being said, you do have to be consistent and have the right brand, and focus on the overall marketing strategy, but whereas you maybe focused on more branding in one market, you may be more focused on more activation in another market. The corporate side taught me that flexibility is key.

On the property side, there are two main things I have learned:

The first is relationships. The most effective way to be successful on the property side is to ensure you’re building the best relationships that you can, because they are the bloodline of your success.

The second is fulfillment. I don’t think that gets talked about too much in sponsorship. Properties that just focus on signing an agreement to hit the numbers, and who don’t really worry about the assets that were promised to be fulfilled, those are the properties and the individuals that wont be very successful. There’s an element of integrity that must be given to make sure the assets are effective for a company. When you show that integrity, you’re able to retain clients, maybe even increase their spending.

The sponsorship world is a very niche world, as we know; that universe that we live in is small, and everyone talks. It’s important to do what you say you’re going to do. If you’ve built a great relationship with someone, and you’re doing an amazing job on the fulfilment of what you’ve promised, then you’re going to be very successful on the property side.

Q: In terms of credit unions as a whole, why do you think there’s been such large-scale growth in business over the last decade? And where do you see credit unions headed in the future?

“The future is bright for credit unions. ”

A: People love the personal and community feel of credit unions. We are doing a lot of good in the communities, and I think people are starting to recognize that. One thing we focus on at Mountain America is helping members achieve their financial dreams. That’s our vision. When a whole company garners that vision and has the same goal, you see a lot of really amazing things happen. We’re not for profit, and we are created to serve and help people save money. By helping the members save money, our members are able to put that money back into the community. That’s why you’ve seen that growth because of what and how a credit union can influence the community. We are able to help our members, enable them to save money, and help them truly achieve their financial dreams.

As far as where they are headed, credit unions really have to maintain growth. That growth is needed to provide the best rates, the best technology, the best products and services, and ultimately the best member experience that we can. The overall credit union philosophy is people helping people. We talk about that a lot here at Mountain America. We are the number one credit union in the western region, and number two nationally for business share accounts. We provide a vital role in helping the economy grow through what we do for our members. The future is bright for credit unions.

Q: What would you say are the three most fundamental sponsorship assets that you look for when procuring sponsorship?

A: #1 would be Media. Traditional media helps support a lot of the sponsorship assets, so making sure (if it’s available), that we have radio, TV, and some of those traditional media outlets is necessary because those are the elements that really help drive traffic.

#2 would be Assets with Repetitive Exposure. In the world of sponsorships you have to separate yourself from the rest of the noise, and in some cases, there’s a lot of noise. You have to make the decision, is there so much noise that maybe we shouldn’t even be there? But in order to stand out, it’s important to have consistent repetition of the brand. You need to tie your name to something that repeats throughout the event that has a positive connotation to it, something that people can latch onto.

And really, the #3 most fundamental asset I look for is some sort of Community Outreach Program. If you link a sponsorship with a cause, that makes it that much more powerful. For example, with our Utah Jazz Sponsorship, we sponsor all the three-pointers: For every three-pointer that the Utah Jazz makes, we donate $50 to the Huntsmen Cancer Foundation. With that you have a repetitive feature that’s tied in with a cause. The fans see your brand consistently, and they have a positive association with it because you’re giving back to cancer research. It helps tie your brand in with the community and really shines a positive light onto what you’re doing as a sponsor.

Q: What is a sponsorship asset that would be a deal-breaker if you couldn’t include it within a sponsorship deal you were negotiating?

A: It would have to be ownership or an element with exclusivity. This goes back to what I was talking about before, with the increase in property numbers to hit. There’s more and more sponsors, and the clutter can get higher and higher, and you have to be able to carve out at least some elements of exclusivity to separate yourself. Even if it’s not a full exclusivity, you definitely want to create some sort of type of ownership with your assets that you don’t have to necessarily share with someone else. Make sure you have that separation.

That being said, some of the properties are going to want to split things up. For example, if there’s 4 quarters of basketball and there’s replay sponsors, a lot of properties will separate it and say, “Okay, 4 separate replay sponsors”. The more you can say, “No, I want to be the replay for the whole time, “ the better.

You have to really try and find those types of elements where you can carve out your exclusivity and own it.

Q: Obviously, one of the reasons you’ve gotten to where you are today is because of your skills in negotiating. What is the one piece of advice you would offer someone who is stepping foot into that boardroom?

A: You have to do all your homework beforehand so you can be educated going into the discussion. If you haven’t done your homework on what’s being discussed, then you’re really at a huge disadvantage.

“You don’t have to create things, you don’t have to make things up, you just have to use the truth. ”

The most important principle in negotiation is using the facts. Being educated with the facts is, as I like to call it, your sword and your shield in negotiation. Your sword, because you can use the facts to justify additional assets, and your shield, because you can explain and defend a fair and reasonable investment.

You don’t have to create things, you don’t have to make things up, you just have to use the truth. The facts will always help you in negotiation. It’s always been that way for me. It takes a little bit more time and effort beforehand going into a negotiation to really get all your facts straight, but if you understand all the facts of the situation you will be so empowered to be able to negotiate effectively.

Q: What is the greatest piece of advice you’ve ever received?

A: I had a church leader tell me once that if you are kind to others, then any negative efforts towards you will be disarmed. Treating people with respect and having integrity is probably the most important quality you can have in any business. That’s really the greatest piece of advice that I’ve ever received from someone.

Q: A lot of people have room to take that to heart, I imagine. Lastly, what skills have been the most valuable in getting you where you are today?

A: That is a good question. The successes that I’ve been able to have are because I have been able to build strong relationships with people. People like to do business with people they like, and being able to connect with others has always been a strength of mine. It takes work and it takes effort. You have to reach out and ask questions to people. You have to try and find out about who people are and also care about who they are. It can’t be fake, you have to be real and genuine about it. That’s the most valuable skill that I’ve been able to develop, just being able to connect with people.

There was a time where I wasn’t as outgoing as I am today. It just takes having uncomfortable conversations and stretching yourself a little bit and then it becomes easier and easier. Now, building those relationships is what matters most to me, and it is the thing I look forward to the most.

5 Quick Q’s

Favourite sport to watch?

College Football

Favourite sport to play?

Basketball

What was the last book you read?

The Greatest Salesman in the World

How do you take your coffee?

I don’t drink coffee.

What 2 things would you want if you were stranded on a tropical island?

That is a tough one, I would want to be able to watch sports, and I want to make sure… well… I should probably flip flop those around!

I want to have my family with me, and I want to be able to watch sports!

Sponsorship Essentials: Q&A w/ Thomas Wills, CEO of BWA

Thomas Wills is the President and CEO of Bonham/Wills & Associates. By 30, he was heading up one of the bigger players in the sponsorship, valuation, and negotiating world. Today, in part one in our series, "Sponsorship Essentials", he sits down with us and lends us valuable insight into the sponsorship and naming rights industry, (all done in 10 minutes or less).

By: Claire Lingley

Thomas Wills is the President and CEO of Bonham/Wills & Associates. By 30, he was heading up one of the bigger players in the sponsorship, valuation, and negotiating world. Today, in part one in our series, "Sponsorship Essentials", he sits down with us and lends us valuable insight into the sponsorship and naming rights industry, (all done in 10 minutes or less).

Q: How did you get into this business?

A: Out of university I had the unique opportunity to work with an industry professional, that being Dean Bonham, who has been a titan in the naming rights world for the last 30 years. He brought me on to work on 2 projects, one of which being a project in Ottawa and the other with the University of Pittsburgh. And really, it just grew organically from there. Although my background was medical sciences, I was able to use a lot of the process information that I learnt during my studies in our valuation and analysis system.

Q: Any advice for someone trying to enter the business?

A: Know your market, and understand that it is a business and that it is not just sports. A lot of people enter the sports industry with the idea they are going to be working in player personnel. At the end of the day, that is not the case. This is marketing, this is sales, this is a business.

Q: BWA specializes in negotiations, any tips for when you’re entering the room?

A: Listen.

Q: Anything else?

A: Keep listening! Also, it is key to understand from the onset of any negotiation that the most successful negotiation is one in which both parties leave satisfied. You will not have continued success in this industry if you try to have one over on the opposing party. Finding the best, fair, and most creative solution is always the goal.

Q: Where do you see naming rights going in the next 5 years?

A: In 2013, we predicted that naming rights were going to spike in 2018 through 2022. We still believe this. And now we have a prediction that naming rights are going to continue to move out of the traditional sports and entertainment venues, and into more cultural and municipal properties. Furthermore, collegiate naming rights are going to increase, with brands expanding their reach with full-bodied packages that interact with students, fans, alumni, etc., enhancing fan experience and further assisting corporations in growing their revenue. The days of just throwing a corporation's name on the side of the building will soon be behind us.

Q: Any inside scoops on untapped markets? You mentioned cultural and municipal properties, what’s one type of property that you think would be great for naming rights and hasn’t been discovered yet?

A: I think transit systems are going to peak. People use these systems every day, and there is a lot of room and potential for naming rights within that industry to grow and expand. I think corporations are going to integrate their technology and enhance the experience of users on a day-to-day basis, which will in turn drive sales and revenue for that corporation.

Q: What’s the best piece of advice you’ve ever received?

A: There’s a saying out there, and I’m not sure how it goes, but I’m a true believer that success is 90% about luck. The more I work, and the harder I work, the more luck I seem to have.

Q: Last question, statement tie or statement socks?

A: Statement socks.

Corporate Sponsorship and School Districts

A lot of times, when partnering with a school district the exposure will extend throughout the high school campus parks and facilities increasing the ability to reach every resident within the district. This creates a real win-win opportunity for quick return on investment.

For years, all across North America, we have seen school district funding fluctuate with the economy. Loss of programs, overcrowded class rooms and outdated facilities have been just a few of the issues many districts have been facing. In the early 2000’s, we really stared to see a trend taking off. The success found for both corporations and school districts through sponsorship has continued to propel like-minded groups to follow suit.

In the past many have looked at these types of partnerships with skepticism, most worrying about oversaturating our schools with corporate initiatives. As these relationships have become more popular, we have seen a drastic shift in perspective and with this shift has come a rapid increase in benefits for both parties involved and their surrounding communities.

One of the trendsetting districts to increase revenue through corporate partnerships was a school district in Indiana. “The nonprofit Penn-Harris-Madison Education Foundation has signed deals that will bring the school district, which includes 11 public high schools in Northern Indiana, more than $600,000 in added revenue in the coming years. The district sold off the naming rights to football stadiums, baseball fields and even a music room”. (Chicago Tribune)

There is an undisputable increase in visibility for corporations within this industry and in turn a massive increased local customer base. The ability to tailor involvement and specifically target demographics, corporations are creating new exposure elements implementing more activation, and in turn maximizing brand awareness of products and services. Additionally, the corporation also gets real chance to make a difference by committing much needed funding to help enhance the community in which they serve.

Back in 2004 Judith Thomas, marketing director for the National Federation of State High School Associations stated: “Corporate involvement at the high school level is about to explode nationwide. It is an unlimited, untapped market and it is in places companies often can’t easily reach (” Pennington”).

In 2005 When Safeway donated $50,000 to a San Francisco School District after around 200 teachers were laid off, their Public Affairs manager Teena Massingill stated: “Giving back to the community is a pleasure and a responsibility,” (McCollum”).

A lot of times, when partnering with a school district the exposure will extend throughout the high school campus parks and facilities increasing the ability to reach every resident within the district. This creates a real win-win opportunity for quick return on investment. Beyond the benefits listed above, corporate partners truly get a chance to make a difference by benefiting not only the community but also the students through the creation of scholarships, mentoring programs and increased fundraising efforts/opportunities. Residence of the community (consumers) will take all of these elements into account when forming opinions about corporate sponsors.

For example, Sweetwater Union High School District, in the San Diego area, has made sponsorship contracts with nearly 300 national and local businesses. This money has gone directly into their sports programs, specifically creating freshman teams and allowed for intramural teams to develop at the middle school level, (“McCollum”).

Moving forward we hope to see this industry trend continue to grow alongside the communities they reside in.

When Sponsors Go Rogue

In our last post, we examined a few instances of brands dealing with the fallout emerging from their sponsored properties falling on the wrong side of law and/or public opinion. This time, let’s take a look at the other side and see what properties do when the brand that’s sponsoring them meets the same fate.

In our last post, we examined a few instances of brands dealing with the fallout emerging from their sponsored properties falling on the wrong side of law and/or public opinion. This time, let’s take a look at the other side and see what properties do when the brand that’s sponsoring them meets the same fate.

Northern Rock was the jersey sponsor for Newcastle United from 2003 to 2012. In 2007 the bank had to be bailed out by the UK government after the sub-prime mortgage crisis, the aftermath of which led many to question the ethics of such financial institutions spending public money on sponsorships. The outcry was heightened further when the bank spent £10 million to renew the deal in 2010. The backlash did hurt some of the PR surrounding the club, which at the time was not finding great amounts of success on the pitch. When the bank finally decided to end the deal, the club was left looking for sponsors within a very short time frame considering that jerseys for the new season had to go into manufacturing.

The case with Manchester United was not very different when they had to wear the AIG logo on shirt for an entire season, despite the bank’s reputation suffering massive blows due to the multiple bailouts it was handed by the US government.

Closer to home, NASCAR had to state that they needed more oversight into sponsor selection when the NRA was announced as the naming rights partner for the Sprint Cup event. While the political aspect of this deal is something that we as a sports marketing firm cannot comment on, the fact that the deal was announced mere days after the Sandy Hook massacre was a definite blunder for all parties.

While these incidents demonstrate that sponsor selection can sometimes lead to unhappy fans, sports properties and teams also need to make sure they are financially viable, which thus requires them to often handle situations such as these delicately. The best way to navigate such proverbial minefields is to know and build relationships with their consumers, or in this case, fans. Keeping an active dialogue with the fan community and conducting research are two ways that will help keep fans updated and will give the property enough time to craft their justification for controversial sponsorship decisions.

$$$ Dollar for Dollar $$$

Naming rights occupy the highest point on the sponsorship pyramid and typically carry with them a number of major benefits for all parties included. This is why we will continue to see these investments increase across industry categories, sports and entertainment venues, events and properties around the globe.

Viewing sponsorship as a cost-effective method of achieving specific marketing objectives, has been the driving factor behind the dramatic increase in Naming Rights over the last decade. Sponsorship marketing is particularly valuable because of its effectiveness in introducing new products, helping new or established products contend with competitive brands, and increasing corporate brand awareness. Increasing brand awareness is a primary factor behind a significant sub-trend within the sponsorship industry over the last several years. It has been proven that "Dollar for Dollar" Naming Rights is the best investment a corporation can make.

Corporate Benefits

- Enormous brand exposure

- Strong connection to iconic civic facility

- Demonstrate commitment to community

- Increase sales through direct access to property's audience and prime hospitality opportunities

- Ability to target specific demographic groups/audience

- Credibility (sponsorships have greater credibility than straight advertising)

- Interactive marketing platform

Property Benefits

- Generate immediate and annual revenue

- Build image/profile of property through linkage with prestigious corporate entity

- Create marketing synergies for an expanded marketing reach

- Eliminate various line-item expenses

General Naming Rights Benefits

- Impactfull branding exposure

- A prestigious association with the property and its tenants

- the ability to rise above the advertising clutter normally associated with sports and entertainment properties

- The opportunity to pre-empt a company's competition from an association with the property

- The potential for lucrative direct and indirect business relationships

Naming rights occupy the highest point on the sponsorship pyramid and typically carry with them a number of major benefits for all parties included. This is why we will continue to see these investments increase across industry categories, sports and entertainment venues, events and properties around the globe.

Naming Rights, A Trip Down Memory Lane.....

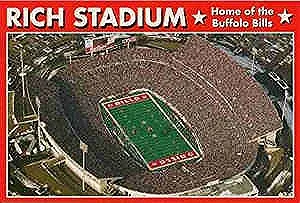

Though the origin of naming rights may be debated, certainly a watershed moment in their development was the 1972-73 naming rights agreement between Rich Products, a Buffalo food manufacturer, and Erie County which enabled the former to put its name on a new football stadium in Orchard Park, New York, the home of the National Football League’s Buffalo Bills. The agreement called for Rich Foods to pay $1.5 million over 25 years in exchange for signage at the stadium and a commercial association with the franchise.

Though the origin of naming rights may be debated, certainly a watershed moment in their development was the 1972-73 naming rights agreement between Rich Products, a Buffalo food manufacturer, and Erie County which enabled the former to put its name on a new football stadium in Orchard Park, New York, the home of the National Football League’s Buffalo Bills. The agreement called for Rich Foods to pay $1.5 million over 25 years in exchange for signage at the stadium and a commercial association with the franchise.

The naming rights phenomenon continued in northern New York when Carrier Corporation, a maker of heating, ventilation, and air-conditioning equipment and refrigeration systems, concluded an agreement with Syracuse University in 1979 to name the school’s new athletic facility. Then, in 1986, Pilot Air Freight purchased the naming rights from the City of Buffalo for the new stadium that housed the Buffalo Bisons, a minor league baseball team.

About this same time, California-based Arco Oil bought the naming rights to the new arena in Sacramento that would be home (Arco Arena) for the Sacramento Kings of the National Basketball Association. In 1988, Great Western Bank became the first company to re-name a facility, theForum in Los Angeles, which was then the home court of the Los Angeles Lakers.

Interest in naming rights really began to gain steam in the 1990's when a slew of professional facilities, starting with the Target Center in Minneapolis (home of the NBA Minnesota Timberwolves), hastened to adopt corporate monikers. Not surprisingly, the fees associated with these sponsorship's also increased—in some cases dramatically.

In the last 15 years, the corporate interest in naming rights has shown no signs of letting up. Based on the latest public information, there are now 113 naming rights agreements currently in place for major league facilities in North America alone, and more than half of them have been done in the last decade. In addition, there are scores of naming rights deals for minor league and collegiate facilities, convention centers, amphitheaters, theaters, even high school stadiums.